Project Overview

Research Team

My role

Understand pain points

Figure out dop-off stages

To Design the flow

Usability testing

Create Wireframes

Visual Designs

Product Manager

2 weeks

Who I worked with

Timeline

Glide Invest

Onboarding Case Study

The Problem Statement

Glide Invest is an App that is trying to solve the problem that people have while picking mutual funds & also creating awarness on diversification of asset..

Our major issue was the onboarding as there we 56% of dropoffs occuring at our risk tolerance section.

SEBI forces advisory apps to get the customers risk profile before suggesting them with any plan

The User Problem

As a user who is not familiar with mutual funds, the first thing they see is the word “RISK”

The Question that were asked were too personal and confusing. Some of the users could not relate to the questions asked

The users have not seen enough value to answer these questions and were forced to do so..

Old Designs - Flow

No skip, critical for personalized plan suggestions without necessary data.

Users were getting confused with the functionality of every screen

In usability tests, I identified high friction with the last two questions.

They were also a little taken back with the word “Risk”

I plan to stop working in

Planning well for an early retirement

is the first step to achieving it!

“

25 & Above

20 Years

15 Years

10 Years

5 Years

Continue

Continue

I want to open an account with Glide Invest to

5 times your monthly salary should be saved in an Emergency Fund.

“

Have some

emergency

money ready

Invest in mid &

long-term goals

Invest in my

short-term goals

Invest in multiple

goals, as needed

Continue

My current investment discipline is

5 times your monthly salary should be saved in an Emergency Fund.

“

No financial

discipline at all!

Regular and

unplanned

Irregular and

unplanned

Regular and

planned

?

🦊

🐌

🦄

Continue

My knowledge of investment in financial assets is

Planning well for an early retirement

is the first step to achieving it!

“

Very familiar

Not familiar

Not Familiar

Continue

With my investments,

I would like to focus on

Steady gains with moderate loss

Avoiding loss at any cost

Beat inflation, whatever the cost

Maximize gains, even at great risk

Planning well for an early retirement

is the first step to achieving it!

“

Continue

If my portfolio loses 20% or more of its value, I’ll

Planning well for an early retirement

is the first step to achieving it!

“

Do

nothing

Sell, if my advisor

asks me to

Buy

more!

Sell, because

my friends are

Welcome to

the world of

guided investing.

Your investments, on auto pilot.

Let’s complete your

risk profile before

portfolio recommendations.

This is a one time requirement and

takes less than 5 minutes

Continue

Why risk profile is required?

The What...

What we were doing..

Instead of simplifying, we were scaring the users at the very beginning! They were’nt seeing enough value..

What we should have..

Instead of holding these 6 questions as a problem, I realised that we can turn it into something that the user will find value in..

Wireframes

Hi, I’m Alia

Sr.Investment Advisor

Let’s get to know you better!

Enter your name

Get Started

“I will guide you throughout your

investment journey!”

With your investments, what do you want to achieve?

Steady gain with moderate loss

Avoiding loss at any cost

Beat inflation, whatever the cost

Maximize gains, even at great risk

Continue

I’ll do it later

Sagar, how do you want to

use Glide Invest?

You’ll still have access to all the features.

I’m new to investments,

Guide Me

Do it Myself

Get a free expert-led plan

Get access to 1000+ direct funds

I am an expert at investing, I’ll

Now let our experts guide you in choosing the right investment plan!

Answer a few questions in 2 mins

Get a personalised Investment plan

Step 1

Step 2

Step 3

Invest in few clicks. Track anytime

I’ll do it later

Let’s Go

Wow Sagar, that was great!

We’re evaluating your investment style..

Balanced investors prefer to reduce risk and enhance their returns equally.

Your investment style is like a Balanced Investor!

Traits of a Balanced Investor

You balance it right

1

You ace the budget game

2

Fun comes first but not at a cost

Your life is a balance and that's what you want from your investments.

You rarely exceed your budget because you plan well.

You know how to prioritise fun without going broke.

3

Wohoo! Unlock Reward!

If your investment value falls by 20%. What would you do?

Ask Advisor

Invest more

Sell investments

Need help to decide

Continue

I’ll do it later

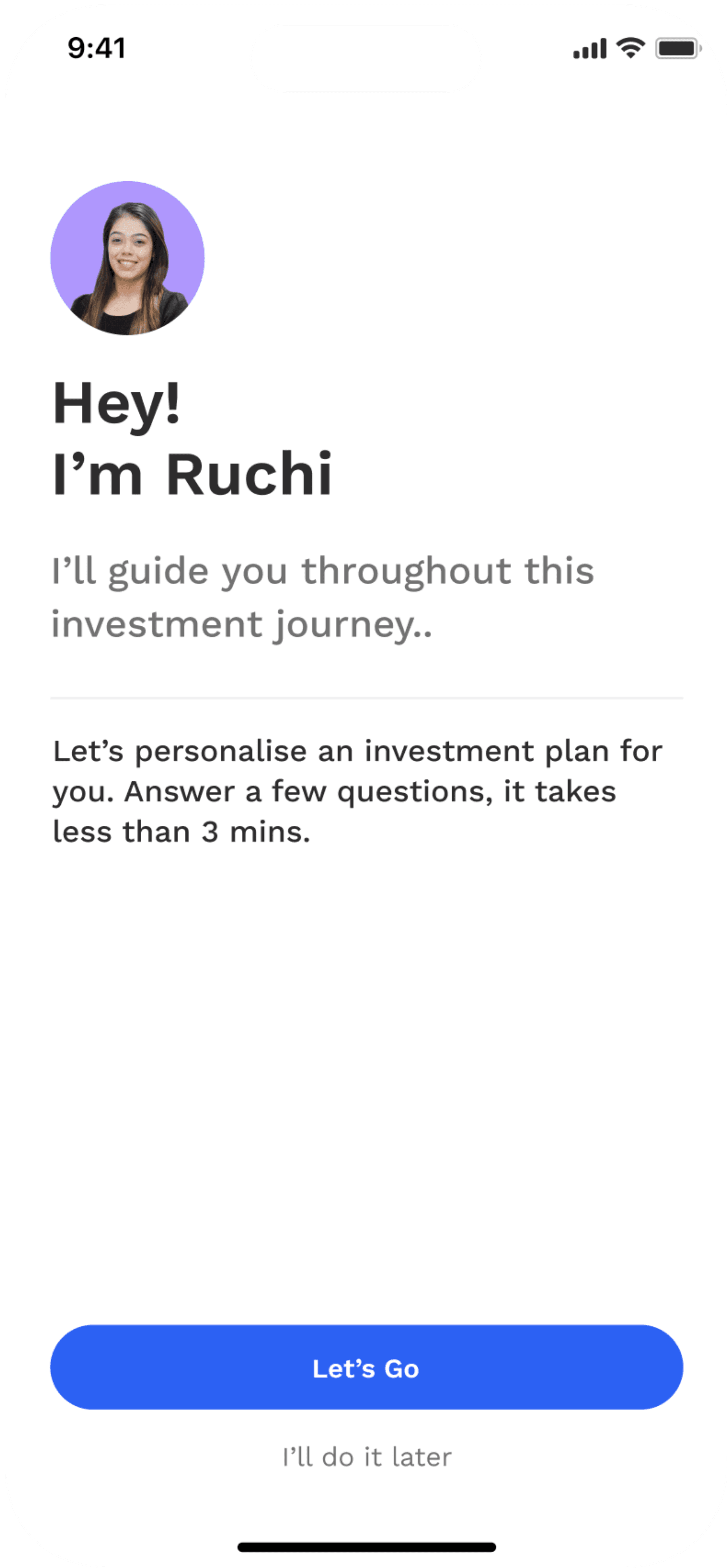

Introduced a wealth advisor on the very first screen, to increase trust

Added a “Feedback” screen after the survey

Experimented with different users flows & re-framed some questions

Assigning you a wealth advisor..

Hey!

I’m Ruchi

I’ll guide you throughout this investment journey..

Let’s personalise an investment plan for you. Answer a few questions, it takes less than 3 mins.

I’ll do it later

Let’s Go

Why do you want to open an account with us?

Invest in short-term goals

I’ll do it later

Continue

Have some emergency money ready

Invest in mid & long-term goals

Invest in multiple goals

Invest in short-term goals

1/6

Tired of working! When do you want to retire?

Haven’t thought of retiring

20 Years & above

15 Years

10 Years

5 Years

I’ll do it later

Continue

2/6

Assigning you a wealth advisor..

You will always have someone to guide you

Hey!

I’m Ruchi

I’ll guide you throughout this investment journey..

Let’s personalise an investment plan for you. Answer a few questions, it takes less than 3 mins.

I’ll do it later

Let’s Go

Why do you want to open an account with us?

Invest in short-term goals

I’ll do it later

Continue

Have some emergency money ready

Invest in mid & long-term goals

Invest in multiple goals

Invest in short-term goals

1/6

Tired of working! When do you want to retire?

Haven’t thought of retiring

20 Years & above

15 Years

10 Years

5 Years

I’ll do it later

Continue

2/6

Final Designs (Pt.1)

Added an animation in the start to bring in a delightful experience

Added a means for the user to skip the survey and do it later

Made the entire survey experience seamless and simple

How disciplined are you in your investments today?

No financial discipline at all

Irregular and unplanned

Regular and unplanned

Regular and planned

I’ll do it later

Continue

3/6

How would you rate your investment knowledge?

Excellent

Good

Above average

Average

I am new to investing

I’ll do it later

Continue

4/6

What do you expect from your investments?

Steady gain with moderate loss

Avoiding loss at any cost

Beat inflation, whatever the cost

Maximize gains, even at great risk

I’ll do it later

Continue

5/6

If your investment value falls by 20%, you will?

Do nothing

Invest more

Sell investments

Need help to decide

I’ll do it later

Continue

6/6

Final Designs (Pt.2)

Wow Siddharth,

that was great!

We’re evaluating your investment style..

Your investment style is like a

Balanced Investor

Things that matter to you

Fun comes first but not at a cost

You know how to prioritise fun by being smart about money.

Stability and growth

You want best of both worlds for your investments - stability and high returns.

👍

Planning is everything

You don’t want luck to drive your investments, so plan ahead accordingly.

Unlock Your Reward!

Your investment style is like a

Growth Investor

Things that matter to you

Far-sighted investments

You’re fine with short-term

market downturns for long-term goals.

👍

Ninja Planner

You set big aspirations and strive to achieve them by planning in advance.

Driven by magic of compounding

You give your investments enough time to appreciate for compounding growth.

Unlock Your Reward!

Your investment style is like a

Defensive Investor

Things that matter to you

Steady investments

You like an investment plan with low risk and steady returns.

All weather investment plan

You look for a strategy that will defend various market cycles & crisis

Ace the budget game

You rarely exceed your budget because you’re an excellent planner.

👍

Unlock Your Reward!

With this entire process, we were able to achieve lower drop-offs and the completion rate of risk-profile increased significantly

Thank You